Facts I think "everyone should know". I'll try to keep it short and theory-free. That said, this is an opinionated selection of facts. It will be too obvious for some but hopefully not too advanced for anyone. This is what I wish someone would have told me X years ago. Alternately, if I were teaching a course in economics 101, this is what I would build a course around. This is (a very imperfect and incomplete draft of) what I think would serve the students' rather than the teachers' interests.

I guess this is aimed at something like a 16-year-old or 19-year-old, someone without much life experience who does not deserve to be steered wrong in the self-interest of a professor's career path.

Source: Brad DeLong http://delong.typepad.com/print/20061012_LRWGDP.pdf

Hey, pretty nice. Wealth isn't everything (it's not love or art or fun), but it makes life nicer. And now there's more total wealth? Sweet. How did that happen? And how do we make it happen? And how do I make it happen to me?

https://twitter.com/isomorphisms/status/436402440678539264, http://t.co/zK4HfR2Bg3

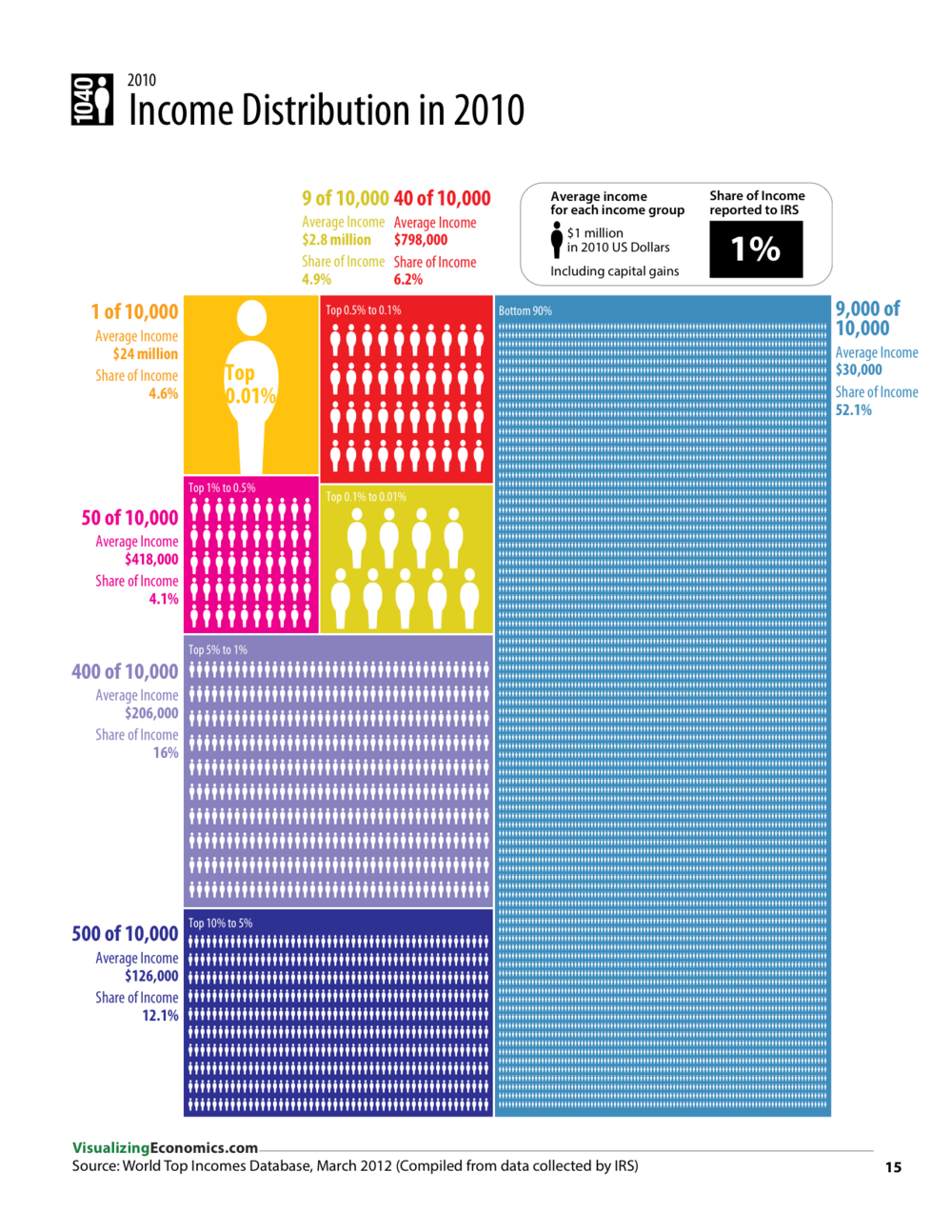

Since the recession many such pictures have appeared (Reich NYT). ((sec:Rhodes)) What I don't like about these is there are so many ways to parameterise the pictures, and it's unclear whether this is bad or good. (What is "the appropriate" distribution? How would you even decide what that means, much less come to an answer?)

[[[wealth answer on quora ... land ]]]

The poorest 5 countries in the world are _______ with populations of _.

https://en.wikipedia.org/wiki/List_of_countries_by_GDP_(PPP)_per_capita

There are some tiny super-rich countries (more like principalities in size --- Liechtenstein, Macau, Bermuda, Isle of Man [[tax haven article]], Monaco [[Monte Carlo gambling article]]], Singapore, Sint Maarten [[tax haven]]], Jersey [[tax haven]], Las Malvinas, Schweitz (tax shelter), Hong Kong (libertarian paradise & trade/financial centre), Gran Caymán (tax haven), Guernsey (tax haven), Belgium (a principality or a country? head of EU and half German/half French), Andorra, Saint Pierre & Miquelon )

After taking them out the richest countries per person are:

- United States

- Norway (oil)

- Ireland

- Australia

- Austria

- Sweden

- Germany

- Canada

- Denmark (oil?)

- Belgium

- Finland

- France

- Japan

- UK

- South Korea

- New Zealand

- Italy

- Israel

- Spain

Notice how many of these are Anglophone (reflecting British occupation in 18th c. [[["there's something about les anglophones"]]] or Deutschephone

http://www.atlas.cid.harvard.edu/explore/tree_map/export/usa/all/show/2012/

- Mali

- Central African Republic (Upper Ubangui / French equagorial guinea / Scramble for Africa / civil wars)

- Democratic of the Congo (formerly Zaïre)

- Burundi

- Somalia

- Burundi

- Liberia (Gadafi)

- Niger

- Mozambique

- Eritrea / Ethiopia

- Burkina Faso

- The Gambia

- Rwanda

- Uganda

- North Korea

- Haiti

- South Sudan

- Sierra Leone ((actually some success after civil war))

- Zimbabwe ((hyperinflation --- Weimar Deutschland))

[pics of the places to show some individuality]

Middle countries are Mexico, Bulgaria, Lithuania, Greece, Slovakia, Russia, Poland, Seychelles, Chile, Argentina, Croatia, Romania, Byelorussia, Thailand, China

- US income per head ~ $50,000

- Colombian income per head ~ $13,000

- Niger income per head ~ $1,000

The variety in each country cannot be reduced to a single number, and the estimates are all flawed. However

The scale from astronomy to microscopy is __, so physicists consider [[40]] orders of magnitude.

- The richest man in the world controls ~72 bn standard IOU's. [[cite Carlos Slim]]

- Subsistence farmers [[the bottom billion -- link]] take in ~300 standard IOU's per year and control [[0? not sure how to estimate that as a wealth.]]

- ("Primitive livers" like Amazonians, Papuans, Andhara Pradesh mountaineers I am leaving off of the scale.)

So 10^9 people have 10^2 dollars and 10^0 people have 10^10 dollars. http://globalrichlist.org

These are the marker posts of the scale of economic variation. (They do not cover its variety; just a reductive one-dimensional summary.)

Some obvious geographical patterns:

- tax haven islands, in El Caribe & near the UK (the world's financial centre before NYC was London [[back to Vereenigde Oost Indische compagnie / Portuguese exploration]])

- Anglophone / Commonwealth

- Da Germans / Prussia

- Lat Am

- Asian Tigers

- oil giants [[[what's the big reservoir called?]]]

- African basket cases / post-colonial civil war zones [^ @AfricasACountry twitter / succes stories in Afrique]

- post-Soviet states

- [[[piketty on oil]]]

- [[[conventional wisdom on natural-resource hell ---- acemoglu / robinson]]]]

You can see how great it is to have legal claim to an abundance of crude oil: something everyone else in the world wants, quite badly. [[[amount of technology and capital committed to the extraction, processing, and delivery of oil]]] [[[big enough to have CME markets]]]

- Qatar

- Norway

- Iran

- Venezuela

- Kuwait

- UAE

- Oman

- Bahrain

- Saudi Arabia

- Doha // al-Jazeera

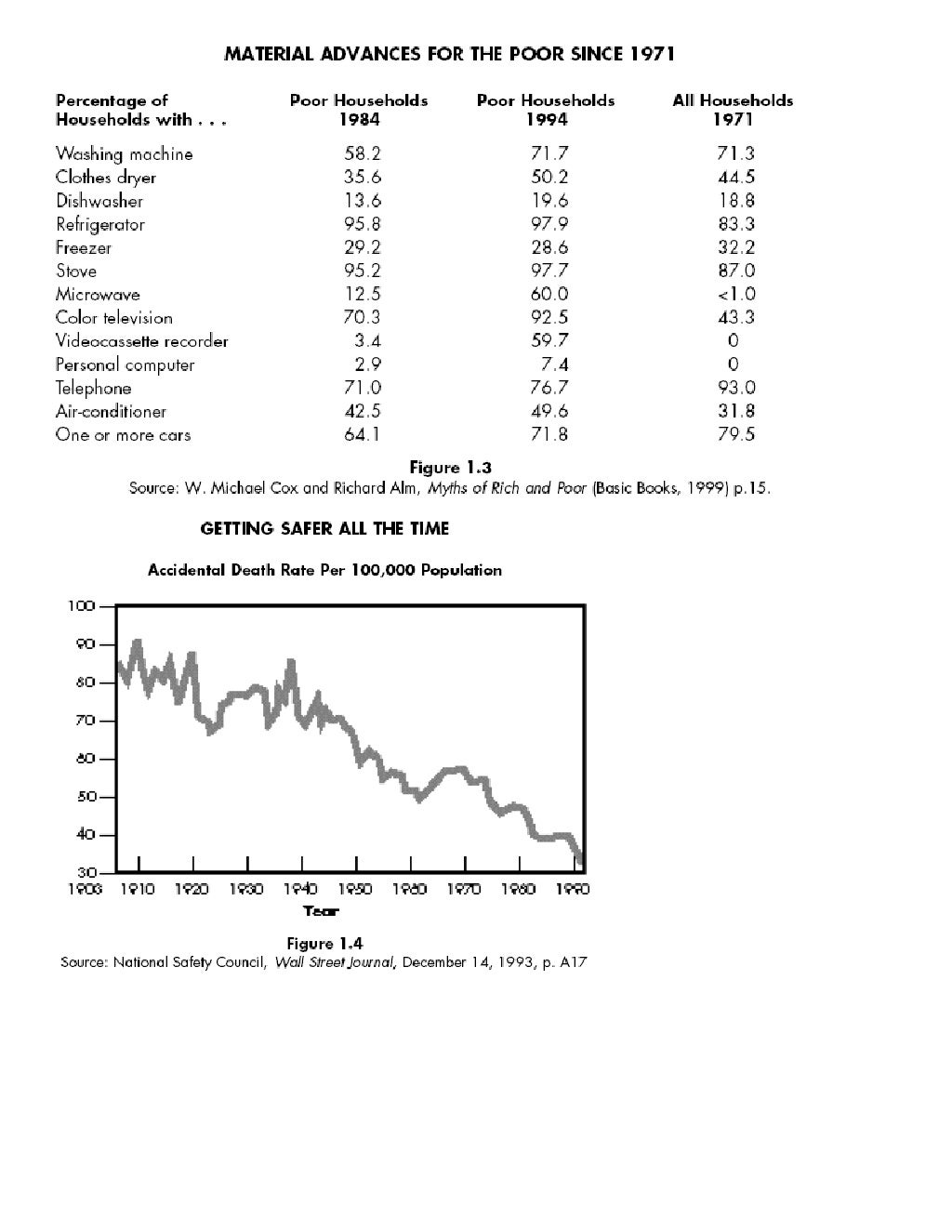

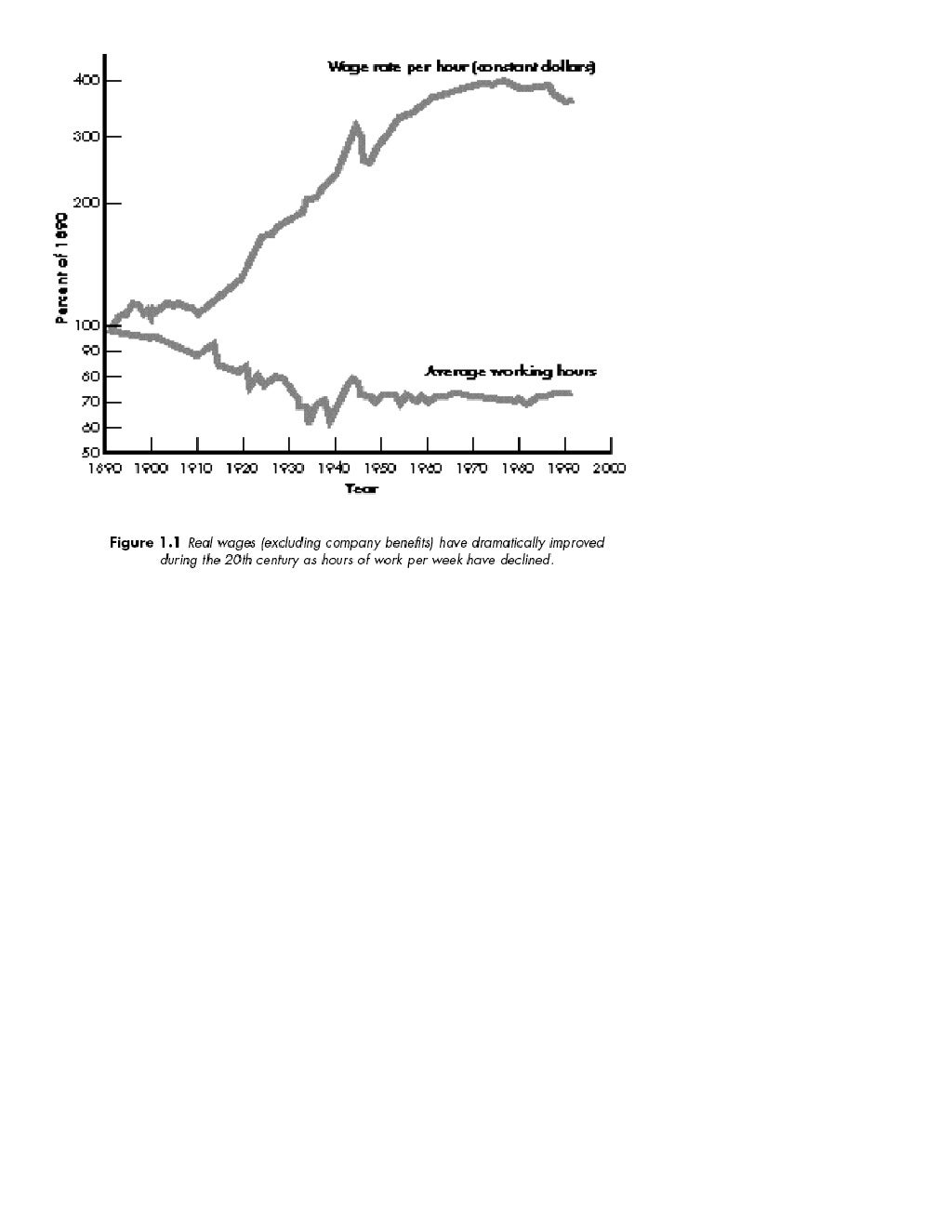

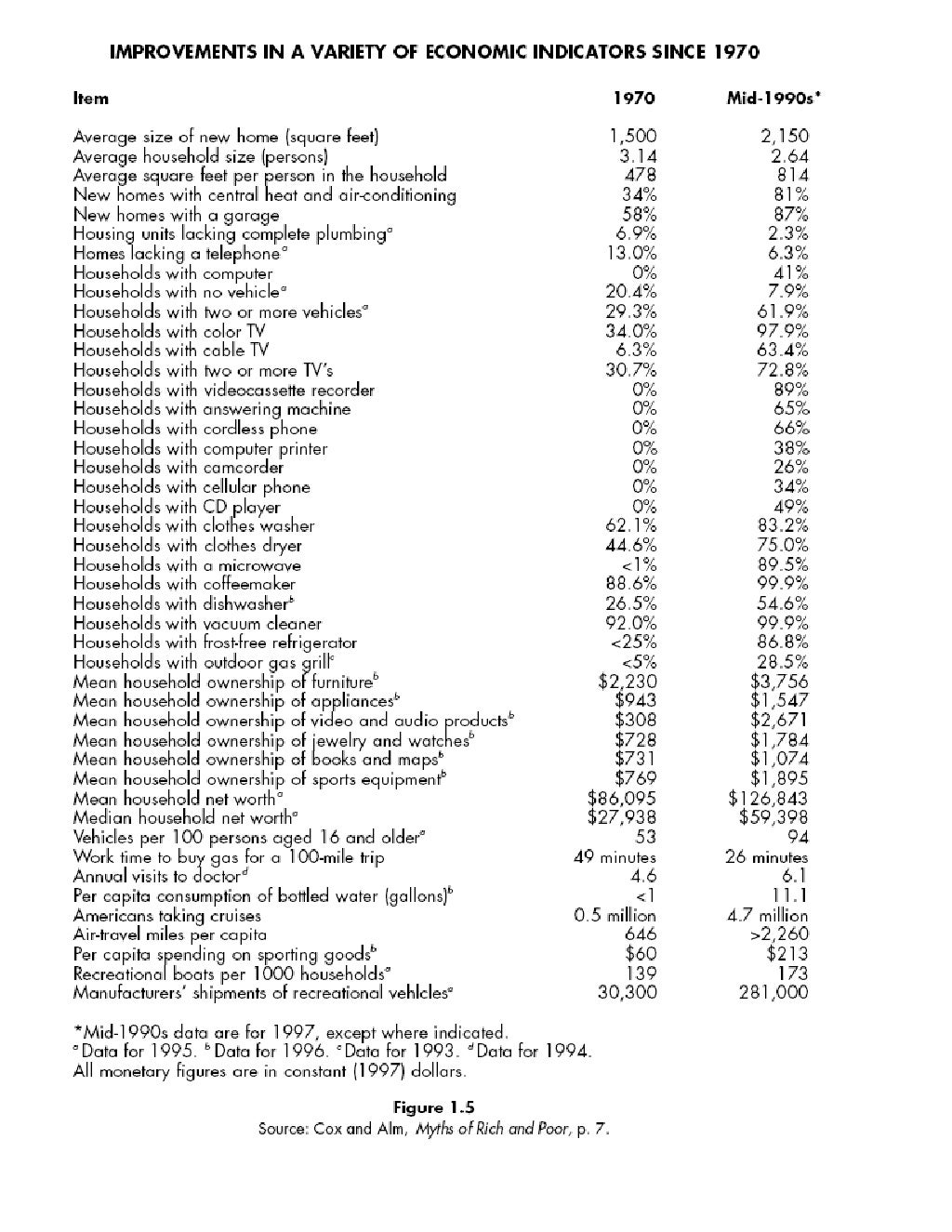

Libertarians love to cite the following successes of capitalism:

However let's not stop there. A high average growth rate and high wealth levels aren't everything.

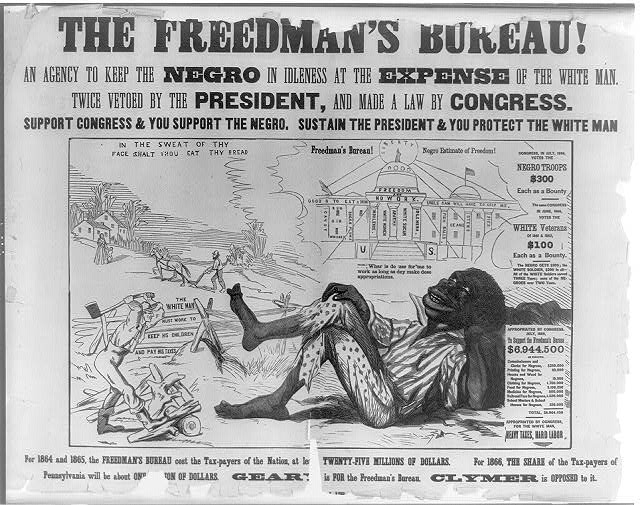

http://t.co/SzbNKdgO1x Source: loc.gov

https://en.wikipedia.org/wiki/Wealth_in_the_United_States#Statistics

Let's look at just the median because all the mean is telling us is how wealthy the entire country is.† There are also a lot of ratios we could look at.‡ Let's pick the dispersion between mean white and median poc, i.e. rich whites versus normal nonwhites. Then let's look at normal whites vs normal nonwhites. (tidyr)

† the average is the total, adjusted for population size (or subpopulation, like White wealth per White)

‡ the ratio mean / median is a measure of dispersion (more total but the middle person doesn't have it)

in thousands of dollars of net worth

| Race or ethnicity of respondent | 1989 | 1992 | 1995 | 1998 | 2001 | 2004 | 2007 | 2010 | 2013 |

|---|---|---|---|---|---|---|---|---|---|

| White non-Hispanic | 130 | 113 | 116 | 137 | 161 | 174 | 193 | 139 | 142 |

| Non-white, or Hispanic | 11 | 20 | 24 | 24 | 24 | 30 | 31 | 22 | 18 |

Of course you could also look at Poc wealth growth over the generation. Wealth growth from $11k to $18k is 60% better. Nothing to sneeze at, and from 1989 to 1992 was a 72% improvement in just 3 years.

[[[look at growth in Dixie wealths / home prices over the period]]] [[ transition into credit / debt remarks? ]]

(Remember this is wealth for Non-Whites, not for Blacks. Blacks being the poorest large category out of Asian/PI, Hispanic, Black, White.)

I'm tired of white people beating us. ―Bill Cosby

I have no accurate knowledge of my age, never having seen any authentic record containing it. By far the larger part of the slaves know as little of their ages as horses know of theirs, and it is the wish of most masters within my knowledge to keep their slaves thus ignorant. I do not remember to have ever met a slave who could tell of his birthday. They seldom come nearer to it than planting-time, harvest-time, cherry-time, spring-time, or fall-time. A want of information concerning my own was a source of unhappiness to me even during childhood. The white children could tell their ages. I could not tell why I ought to be deprived of the same privilege. I was not allowed to make any inquiries of my master concerning it. He deemed all such inquiries on the part of a slave improper and impertinent, and evidence of a restless spirit. ―Frederick Douglass, self-taught reader and writer

Source: https://www.gutenberg.org/files/23/23-h/23-h.htm (who finances Gutenberg?)

Whoa! Take a few days to ponder those numbers. Non-whites have ______. Non-homeowners have __. How you like me now?

[ ^Whites means White Non-Hispanics. Non-whites includes Asians, who have more money than whites; Hispanics (even if they are white), Blacks (the lowest large group, despite some very materially successful blacks [[Ken, William, Ursula]]), Pacific Islanders, Alaskan & Aleutian, and various mainland American Indians, plus "Other Races" (Hmong, .......) ]

If the capitalistic growth is mostly just benefiting rich white people, then I don't really see the point. In my opinion the wealth of the poor is a better gauge.

(I am not saying Blacks are all poor or that all are descended from slaves, see my sheaf theory post.)

[dumb cowen npv recompense thing? africa gdp thing?]

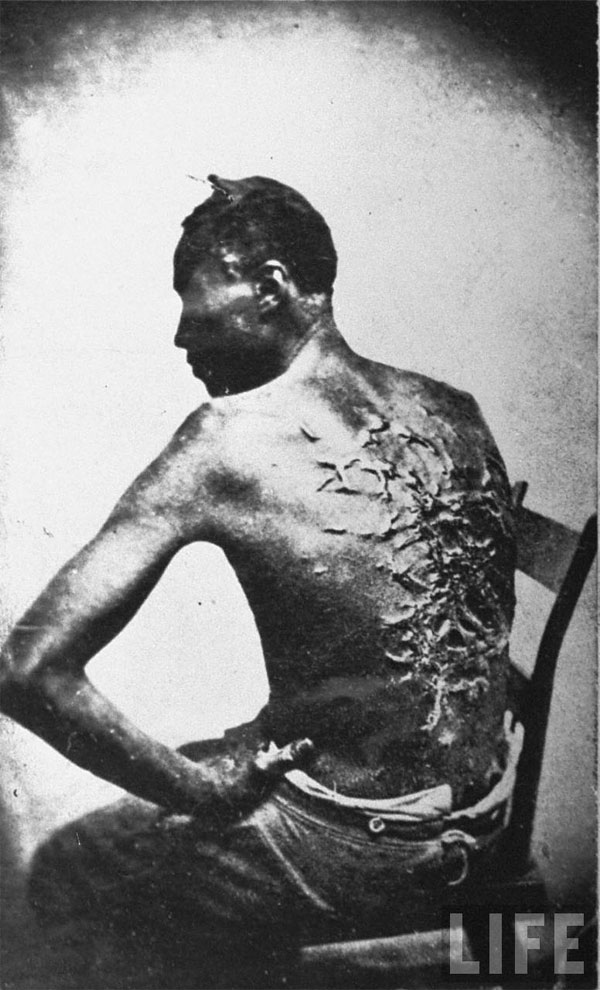

A short story: Mammoth Caves, military industry, building the DuPont legacy, political connections, and Delaware's contemporary status as a favourable tax location.

((cite self-taught greek/latin cave explorer .. kentucky .. jefferson .. DuPont))

https://en.wikipedia.org/wiki/Stephen_Bishop_(cave_explorer)

Stephen Bishop (c. 1821–1857) was a mixed race slave (freed by manumission in the year before his death) famous for being one of the lead explorers and guides to the Mammoth Cave in the U.S. state of Kentucky. Bishop was introduced to Mammoth Cave in 1838 by his owner, Franklin Gorin (1798–1877),[1] who purchased the cave from the previous owners in the spring of 1838. Gorin wrote, after Bishop's death:

I placed a guide in the cave --- the celebrated and great Stephen, and he aided in making the discoveries. He was the first person who ever crossed the Bottomless Pit, and he, myself and another person whose name I have forgotten were the only persons ever at the bottom of Gorin's Dome to my knowledge.

Bishop was freed in 1856, seven years after the death of his owner, in accordance with Dr. Croghan's will. Bishop died on June 15, 1859, according to the date on his tombstone, before he could carry out his life's dream of buying the freedom of his wife and son and traveling to Liberia. His expressed life's dream of traveling to Liberia may have been "politically correct" talk to convey an impression of personal ambition in a non-threatening way to white visitors.[citation needed]

STEPHEN BISHOP, FIRST GUIDE & EXPLORER OF THE MAMMOTH CAVE. DIED JUNE 15, 1859 IN HIS 37 YEAR.

Stephen was a self-educated man. He had a fine genius, a great fund of wit and humor, some little knowledge of Latin and Greek, and much knowledge of geology, but his great talent was a knowledge of man.

https://en.wikipedia.org/wiki/Mammoth_Cave_National_Park#Earliest_known_history

The land containing this historic entrance was first surveyed and registered in 1798 under the name of Valentine Simons. Simons began exploiting Mammoth Cave for its saltpeter reserves.

In partnership with Valentine Simon, various other individuals would own the land through the War of 1812, when Mammoth Cave's saltpeter reserves became significant due to the British blockade of United States's ports. The blockade starved the American military of saltpeter and therefore gunpowder. As a result, the domestic price of saltpeter rose and production based on nitrates extracted from caves such as Mammoth Cave became more lucrative.

The Mammoth Cave's saltpeter resources were instrumental in early US wars, and in building the wealth of the

(largest taxpayer in modern-day Delaware, which permits Delaware's government to finance itself along with favourable incorporation laws and a 0% sales tax.)

(((connections between Founding Father Thomas Jefferson, and the DuPont family. How DuPont's got their first war contract)))

1803-1921 largest U.S. maker of explosive black powder, a once-important and now-obsolete 19th-century technology

Founded by Eleuthère Irénéé du Pont (1771-1834), the Brandywine River Mills became the largest maker of explosive black powder in the United States. That success resulted directly from the firm's pioneering use of gunpowder processing machinery driven by water wheels and water turbines. Divided into separate buildings to promote safety, its rolling, graining, and glazing mills produced black powder in a range of grades for military, sporting, hunting, construction, mining, and other applications.

From age 16 to 20, Eleuthère Irénéé du Pont had assisted Antoine Lavoisier, chief of the French gunpowder works at Essone (and founder of modern chemistry). After the du Pont family immigrated to the United States from France in 1800. Du Pont immediately put his expertise to work, upon seeing the power quality of American gunpowder used for hunting guns and pistols.

In 1802 he sited and began building the mill along the Brandywine River near Wilmington. In 1803 the mill refined its first saltpeter, and du Pont notified family-friend President Thomas Jefferson and soon received Army contracts for refining saltpeter, followed by substantial orders for gunpowder. Brandywine River Powder Mills produced its first gunpowder in 1803.

- industriousness

- ambition

- political connections

- novel technology

- spoils of war

http://www.nps.gov/maca/learn/historyculture/history4.htm

1812, the cave’s worth increased over 25 fold in a single day. Hyman Gratz had purchased a half-interest in the cave from Fleming Gatewood for $10,000. Gatewood, along with Charles Wilkins, had bought the cave from Leonard and John McClean, who had bought it from John Flatt, who had purchased the land and the cave from Valentine Simon for $116.67 only a few weeks before. Then, on July 9, all parties cleared title, determining the cave’s exact worth. There was money to be made from the cave, and Gratz and Wilkins set about making it. They had the capital and physical assets – in the form of nearly 70 slaves – to mount a considerable enterprise underground. The slaves began to construct the apparatus which would leach the nitre out of the soil, under the watchful eye of overseers, by the light of dim and smoky lanterns.

Bare from the waist up, the slaves began their work …

They then packaged these crystals to be delivered to the newly-formed DuPont chemical company in Delaware to be made into gunpowder.

Competitive labor markets are meant to empower workers exactly when employers are forced to pay more. For example:

www.nybooks.com/blogs/nyrblog/2015/jul/25/nail-salons-new-york-times-got-wrong

My wife has learned that if she is unable to assure her employees that they will earn a total of at least $100 a day, nobody will work for her.

Because of the stark differences between North & South Korea, East & West Germany, Taiwan & 大陆, and pre/post Deng Xiaoping's "opening" of China, you cannot argue that capitalism does not create greater wealth than communism.

Capitalism created wealth in the 20th century. Communism created less and they had access to the same technology. Greater wealth means an easier and more comfortable life. So there is something that we want about capitalism. But what exactly is it? And how much of the bad stuff can we get rid of?

[[[[pictures of poor people

Long before the crisis of 2008, people have wanted a kinder, gentler capitalism. Does

You don't need to adopt ad-hoc views about government versus corporate management. There might be some differences between the people who go into one versus the other, but the stereotypes about college sophomore hippies who read Saul Alinsky versus the red-blooded business students who misunderstand Gordon Gekko's purpose in Wall Street (www.youtube.com/watch?v=ArS16ZyOxLQ) ---- are lazy, insufficient guides to characterise government vs business. Both are complex organisations. Both employ lazy risk-haters. Both require layers of communication and compromise. Both work with other people's money. Businessmen often serve on city councils. Etc.

A simpler reason that lawmakers shouldn't delve into the details is that it's too hard. Go to a few city council meetings wherever you live. Ask yourself if you are an expert on par with interested parties in:

- how to insulate a home

- the best kind of fire alarms

- how to design roads safely

- how to encourage both positive & negative feedback from the people you serve when you make the wrong call

- how to

It ain't easy or fun. And people who critique politicians out of hand for being stupid are lazy non-thinkers. Inform yourself or shut up; you have the internet, so you have no excuse.

I will list several ways that various layers of US federalist government intelligently avoid making decisions they are not equipped to make. The desire to devolve decisions is in my opinion a sign of great intelligence on the part of federal and state lawmakers.

I'll give some examples below.

- exempting municipal bonds from federal tax

http://www.theworldeconomy.org/

Over the past millennium, world population rose 22–fold. Per capita income increased 13–fold, world GDP nearly 300–fold. This contrasts sharply with the preceding millennium, when world population grew by only a sixth, and there was no advance in per capita income.

From the year 1000 to 1820 the advance in per capita income was a slow crawl — the world average rose about 50 per cent. Most of the growth went to accommodate a fourfold increase in population.

Since 1820, world development has been much more dynamic. Per capita income rose more than eightfold, population more than fivefold.

Per capita income growth is not the only indicator of welfare. Over the long run, there has been a dramatic increase in life expectation. In the year 1000, the average infant could expect to live about 24 years. A third would die in the first year of life, hunger and epidemic disease would ravage the survivors. There was an almost imperceptible rise up to 1820, mainly in Western Europe. Most of the improvement has occurred since then. Now the average infant can expect to survive 66 years.

The growth process was uneven in space as well as time. The rise in life expectation and income has been most rapid in Western Europe, North America, Australasia and Japan. By 1820, this group had forged ahead to an income level twice that in the rest of the world. By 1998, the gap was 7:1. Between the United States and Africa the gap is now 20:1. This gap is still widening. Divergence is dominant but not inexorable. In the past half century, resurgent Asian countries have demonstrated that an important degree of catch–up is feasible. Nevertheless world economic growth has slowed substantially since 1973, and the Asian advance has been offset by stagnation or retrogression elsewhere.

- delong

- maddison

- homer/sylla

- victorian economy

- viet nam (jeff mcginn)

(ref: banking)

https://twitter.com/isomorphisms/status/468241517027405824

Was it about technology? Property rights? Limited-liability?

And what do past periods of growth tell us about our service economy and website adventurists in the low-growth 21st century?

http://web.mit.edu/lienhard/www/ahtt.html

[[[figures]]]

The life forms on our planet have necessarily evolved to match the magnitude of these energy flows. But while “natural man” is in balance with these heat flows, “technological man”1 has used his mind, his back, and his will to harness and control energy flows that are far more intense than those we experience naturally. To emphasize this point we suggest that the reader make an experiment.

Experiment 1.1 Generate as much power as you can, in some way that permits you to measure your own work output. You might lift a weight, or run your own weight up a stairwell, against a stopwatch. Express the result in watts (W). Perhaps you might collect the results in your class. They should generally be less than 1 kW or even 1 horsepower (746 W). How much less might be surprising.

www.youtube.com/watch?v=S4O5voOCqAQ (Olympic cyclist with huge legs cannot toast a piece of toast)

Thus, when we do so small a thing as turning on a 150 W light bulb, we are manipulating a quantity of energy substantially greater than a human being could produce in sustained effort. The power consumed by an oven, toaster, or hot water heater is an order of magnitude beyond our capacity. The power consumed by an automobile can easily be three orders of magnitude greater. If all the people in the United States worked continuously like galley slaves, they could barely equal the output of even a single city power plant. Our voracious appetite for energy has steadily driven the intensity of actual heat transfer processes upward until they are far greater than those normally involved with life forms on earth. Until the middle of the thirteenth century, the energy we use was drawn indirectly from the sun 1 Some anthropologists think that the term Homo technologicus (technological man) serves to define human beings, as apart from animals, better than the older term Homo sapiens (man, the wise). We may not be as much wiser than the animals as we think we are, but only we do serious sustained tool making.

using comparatively gentle processes — animal power, wind and water power, and the combustion of wood. Then population growth and defor- estation drove the English to using coal. By the end of the seventeenth century, England had almost completely converted to coal in place of wood. At the turn of the eighteenth century, the first commercial steam engines were developed, and that set the stage for enormously increased consumption of coal. Europe and America followed England in these developments. The development of fossil energy sources has been a bit like Jules Verne’s description in Around the World in Eighty Days in which, to win a race, a crew burns the inside of a ship to power the steam engine. The combustion of nonrenewable fossil energy sources (and, more recently, the fission of uranium) has led to remarkably intense energy releases in power-generating equipment. The energy transferred as heat in a nuclear reactor is on the order of one million watts per square meter.

So one way to think about then versus now is that the industrial revolution gave us power generation and power consumption.

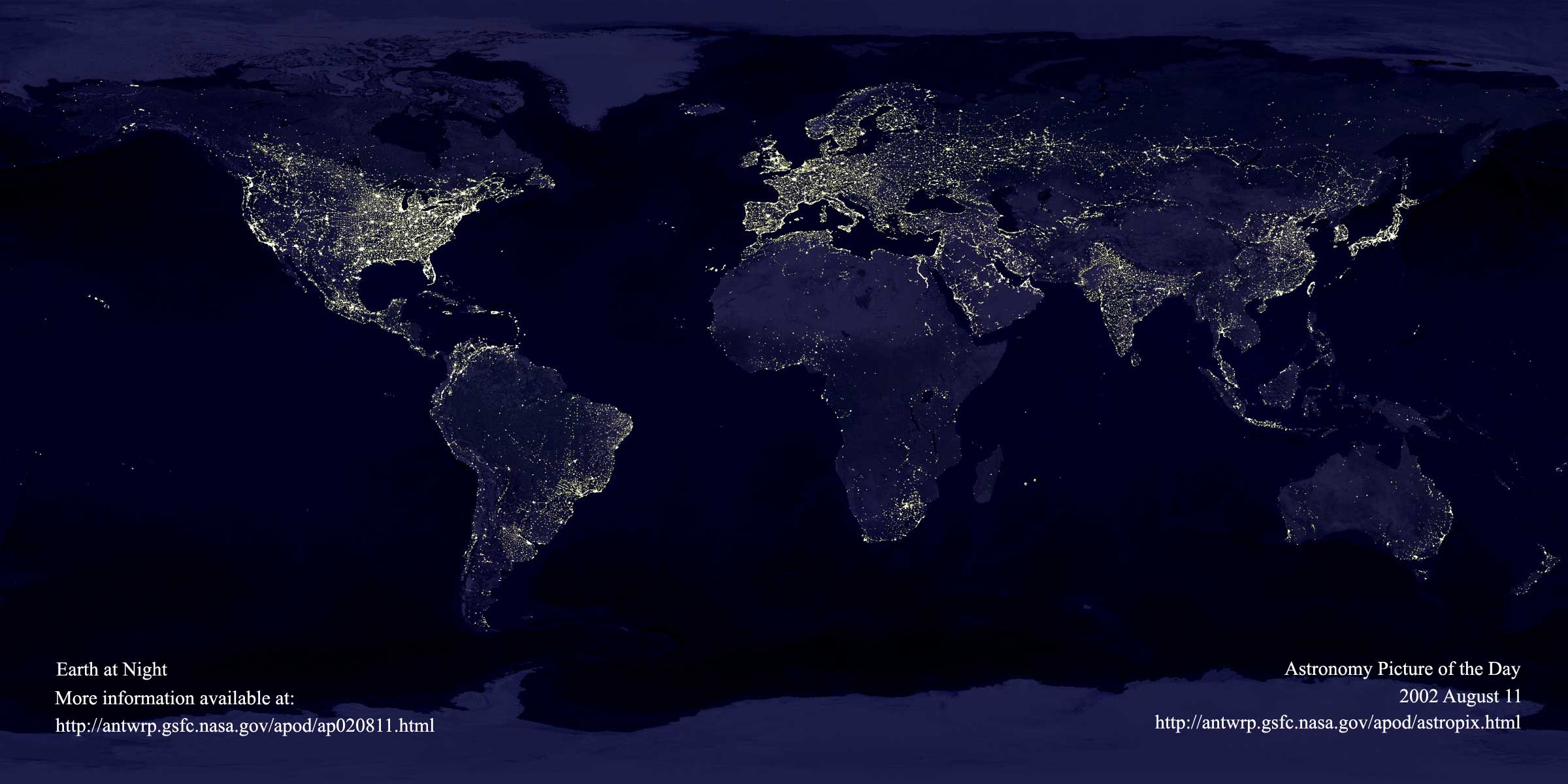

#####Electrification the world over

Electrification of the world: data.worldbank.org/indicator/EG.ELC.ACCS.ZS

fuel sources in the us - http://tmblr.co/ZdCxIy13ixiO5

Not everybody gives the discovery and recovery of the Marcellus Shale patch in Pennsylvania the credit it is due for ending the US recession. [^ Geithner does not mention it in his book for example.]

[[[jobs numbers

[[fracking

The US tax code has a separate category for depletion so don't think this oil stuff is peanuts.

[[[[figures on size and capital intensity of global oil industry]]]

(Numbers go million, billion, trillion, quadrillion, quintillion, sextillion, septillion, octillion, nonillion, decillion, ..... So quadrillion is 1,000,000,000,000,000. [[[W|A BTU's

Electric power consumption per capita: http://data.worldbank.org/indicator/EG.USE.ELEC.KH.PC/countries/1W?display=graph

(Someone trying to be "interesting" wrote in the 90's a little bit about the history of the dynamo http://www.slate.com/articles/arts/the_undercover_economist/2007/06/the_shock_of_the_new.html and how long it took

This was due to economic factors, not engineering factors per se. [[[[A standard comment: Increasingly efficient airplanes, cars, and power generators do not necessarily reduce pollution. Because the extra efficiency will lower prices. Lower prices of transport or home/business/farm/industrial electricity will increase usage because of economics. So we can't necessarily solve pollution by better engineering, or at least people will work against us. On the other hand we could not rely on our intelligence to invent superior ways of doing stuff and simply invert the problem: tax electricity and you can reduce usage, without having to invent anything. This has the obvious downside that then you don't get to have as much electricity as you wanted.]]]]

www.economist.com/node/16846402

Every year $__ trillion worth of bonds change hands globally.

For comparison the sum total value of all public companies [^ NB: calculating the price based on the marginal is not really correct because as you tried to sell all of the company's shares, the price might change.] is ~~. And xyzabc changes hands each year.

Companies are owned by shareholders (equity, which is traded in the New York Stock Exchange [[[pic]]], Frankfurt, ....)

Some shareholders are mutual funds, pensions, or ETF's. In other words groups that have pooled their money together to own fractions of many companies [^and perhaps own fractions of other things, like forests [[[link]]] or future claims on [[[cow types /// wheat types]]] --- the other things might trade in a different location like Chicago or Kansas City.]

Companies also borrow money. Borrowing = − debt = bonds. Equity = ownership = shares ≠ bonds. Corporate earnings go first to bondholders

In order to bring things to a market they need to be similar. Commodity exchanges for example have a lot of rules about what the delivered product needs to be.

[[[brahmin cows]]]]

[[[gold delivery ]]]

[[[fcoj history ... https://www.theice.com/publicdocs/ICE_FCOJ_Brochure.pdf ... http://www.ultimatecitrus.com/pdf/fcoj.pdf ... brown

Think about rice. Only if the rices are all equivalated somehow can they be mixed together and sold en masse. If they can be mixed together then third-parties can trade it even if they don't want or make rice.

For example wheat traders do not want to take delivery, they simply "make a market" for wheat. Pit traders would aggressively buy and sell slips of paper worth __ bushels of wheat to each other throughout the day, speculating on the ultimate value at delivery.

With things like steel people go to a lot of cost and might actually destroy value, to bring the steel to market. Say you have an awesome steel sculpture. If you can't find someone who agrees it is awesome and sell it to them and deliver it to them, you might melt it down so that its only value is as a commodity.

Buttonwood Agreement, which took place on May 17, 1792, started the New York Stock & Exchange Board now called the New York Stock Exchange. This agreement was signed by 24 stockbrokers outside of 68 Wall Street New York under a buttonwood tree. The organization drafted its constitution on March 8, 1817, and named itself the "New York Stock & Exchange Board". In 1863, this name was shortened to its modern form, the "New York Stock Exchange".

- the brokers were to deal only with each other, thereby eliminating the auctioneers, and

- the commissions were to be 0.25%

We the Subscribers, Brokers for the Purchase and Sale of the Public Stock, do hereby solemnly promise and pledge ourselves to each other, that we will not buy or sell from this day for any person whatsoever, any kind of Public Stock, at a less rate than one quarter percent Commission on the Specie value of and that we will give preference to each other in our Negotiations. In Testimony whereof we have set our hands this 17th day of May at New York, 1792.[1]

Source: Wikipedia

information, coördination, competition, and advantage in intra-day trading = dealing = market-making

https://books.google.com/books?id=Rd9hDRR1Yx4C&lpg=PP1&pg=PP1#v=onepage&q&f=true

http://www-bcf.usc.edu/~lharris/Trading/Book/Book-extract.pdf

It's this drive to make things exchangeable at a unified trading point that makes it so hard to get a mortgage if you're self-employed. Maybe it is or isn't true that a W-2 job is more stable than the higher-paying 1099 one you have. What is sold on (in packets of 10,000 mortgages at a time [[[link]]) and traded to third-party financial institutions is a conforming mortgage.

Local banks don't need to, themselves, hold enough money to buy every house in town. If they originate conforming mortgages and sell them on to people who do have boatloads of money, then they have a repeatable, scalable, fee-based business. Each conforming mortgage is so many dollars. It's a uniform process like an assembly line. It doesn't mean your job isn't valid, just that people who don't fit in the box are harder to pack together and sell as a conforming packet of 10,000.

Is it unfair of them not to loan you money? If I were a conservative I would say it's their prerogative and nobody owes you a loan, however the US has laws that make certain businesses to some extent public institutions. Even if you want to rent a room in your home you are not allowed to discriminate on certain bases. [[[craigslist -- fair housing]]]

Some people like to pretend fairness isn't part of it but in a lawful society it is. We also regulate exchanges and securities offerings. You can't just do whatever you want, sort of like how you can't hire a hit man or tell certain kinds of lies with certain kinds of products. (For example you can lie about supplements all you want, but not about food or drugs.)

In general the law balances freedom with fairness. Capitalism as we know it exists only within a system of laws, and capitalism as we know it has never arisen outside a system of laws. It would be inconceivable to make the kind of money Warren Buffett has made without policies to protect fairly earned wealth. Imagine two boys playing by themselves with no adults around. They make a bet for five dollars. The one who loses refuses to pay and they punch each other. No money is exchanged. This is what I think would happen instead of a carefully regulated system of trust that is necessary for the function of exchanges like the CME. [[[[link to CME stuff

If labour markets were like the CME, then you would be able to buy and sell large packs of "work units", let's say 10,000 hours per contract. It would not have to be "generic work". We don't trade "generic cows" or "generic oil" or "generic steel" either.

For this reason I do not believe "the labour market" is a market in the usual sense of the word.

I've seen market-like things in labour. For example day-labourers will all show up at a an appointed place at 5 in the morning and then scramble for work as whoever that wants "generic manual labour" and can pay cash same-day picks them up in a truck and drives off to the job site. But I think as skills diversify even a little [[[free grou picyture]]] it stops working this way. If you're a flooring expert or an electrician or a journeyman anything, there ceases to be a gathering-market and it starts to look more like the familiar office-work pattern of sending résumés / curriculum vitæ and establishing long-term relationships. [[[insider-outsider dynamic paper link

[[tale of exploitation w/o papers

- recruiter websites

- Indeed / W|A data

- CEO job ads

- professor job ads

Stores in the United States post an offer and you cannot haggle it. Bix box stores contain loads of goods from just one company. Their suppliers may compete with each other but at the consumer end once you're inside Wal Mart you are probably going to buy most of your stuff there. You would have to hoof it across town and you can't see what's in the other store so might as well go with the W. [^ This is a point where I think rationalistic economist models are irrelevant. Rational purchasing may happen over the long run ---- whatever that means --- or it may happen at the supplier level where Wal-Mart squeezes greater profits by muscling against its suppliers. However that is in the back end not at the direct consumer end.]

Stores are also "designed, not emergent". The ladies with the spices can sit wherever they want and readjust throughout the day. The buyer can saunter around. Grocery stores are the complete opposite, they have experts deciding "from the top down" [^fugly 90's speak] what to put next to each other on the shelves.

[[[photo of jojoba]]]

[[[photos of nice retail from my moduli regression post]]]

https://books.google.de/books/about/Wal_Mart.html?id=2ReKQgAACAAJ&redir_esc=y

http://muse.jhu.edu/journals/ens/summary/v010/10.4.bailey.html

http://delong.typepad.com/sdj/2013/02/to-slee-no-one-makes-you-shop-at-wal-mart-chapter-1.html

(Tom Slee is @whimsley on twitter.

In fact market-places are tourist destinations for Europeans and North Americans because we have no markets to speak of. (Bon Marché, despite the name, is not one.)

Source: https://www.happytellus.com/gallery.php?img_id=5683

Try to imagine how people would interact at this actual market. Like two gas stations across the street from each other with different prices [[[bertrand competition]]]], I don't think she is going to get away from over charging relative to her friend. Well it depends how good of friends....

(source...)

https://www.flickr.com/photos/gilad_rom/852354376/

Anyway. Is this a more efficient means of social organisation? I am not sure, but I know that Kroger, Tesco's and Wal-Mart are unlike these actual markets.

https://youtu.be/1mC4tu1NhUA The S&P pit on a big down day (May 6, 2010)

https://youtu.be/1mC4tu1NhUA The S&P pit on a big down day (May 6, 2010)

pepsi/coke fmri

[[[[old ads website]]]]

What's the difference between Folgers instant coffee and Starbucks instant coffee? Starbucks comes in a tiny packet (not a large can), it's decorated by the favourite small-daily-luxury brand of the median culture, and it's not called “instant coffee”. “Instant” is like pre-sliced bread: it speaks to the atomic-age not to the post-industrial organic age.

a_

(NB: After writing this I can't stop singing "The best part of waking up" in my head.)

(most common ad for me to see online. so obviously ... they make money off these ads! will you make money off their product?)

https://twitter.com/isomorphisms/status/604712886598922240

- surface stains

- http://www.mayoclinic.org/healthy-lifestyle/adult-health/expert-answers/whitening-toothpaste/faq-20058411

- active ingredients

- guarantee (one per person .. get your $3 back)

- answer objections (enamel)

- façade of scientificity (80%)

- "what the customer wants" ((Conwell)) — white teeth (sex appeal, professionalism, are they so different?), not "they won't fall out"

- feature marketing

- low prices

- high end (eg jeans)

- freakonomics example

- toothpicks "nice 'n' strong"

- barbasol

https://twitter.com/isomorphisms/status/522532271614476289

https://twitter.com/isomorphisms/status/522680282730991616

TED talks backed by Goldman Sachs, letting you know all the answers that rich people and professors will solve the world with

[[easterly, adam __, zizek obscene bribe]]

There are certain stories that always get told alongside a product.

Whenever anyone mentions Alfred Kinsey, they say he was an entomologist first (disarming the notion he was a pervert).

Whenever anyone talks about Bon Iver's album "For Emma, Forever Ago", they mention where it was composed: in a cabin, in Wisconsin, after a breakup. The cabin-in-Wisconsin narrative (it's a little longer than what I said) sticks to your ribs. It stays with you and colours the experience of the album. I don't think the album would have worked as well without the story.

[^ On the other hand, Grey's Anatomy featured the song in the background without context, so what do I know? ]

Does the shape of gumdrops matter? Or Hershey kisses?

[[Case study about the packaging

[[[wine labels]]]

[[[beer labels]]]

- diaper labelling company

- digimarc

- inc 5000

- bottling company

- egg carton company

One of the advices they used to give in B-school is to think about B2B because it's a more rational market and larger. Consumers are fickle and hard to predict unless you're really good. Businesses have more definable needs.

You can check right now here: http://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/Historic-Yield-Data-Visualization.aspx

That is the cost of future money. For example on Sys.Date() == 2015-07-31 the yield on 1-year Treasury notes is 0.36%, which means that $100 will become $100.36 and $10,000 will become $10,036 in one year's time. If you spent $10,000 on 1-years that day you would receive $10,036 in one year's time.

I am being inaccurate by calling it "future money" but it's close enough.

or http://www.bloomberg.com/markets/rates-bonds has some non-US bonds.

Obviously this is related to inflation (how much money will circulate in the future [[[[velocity]]]]

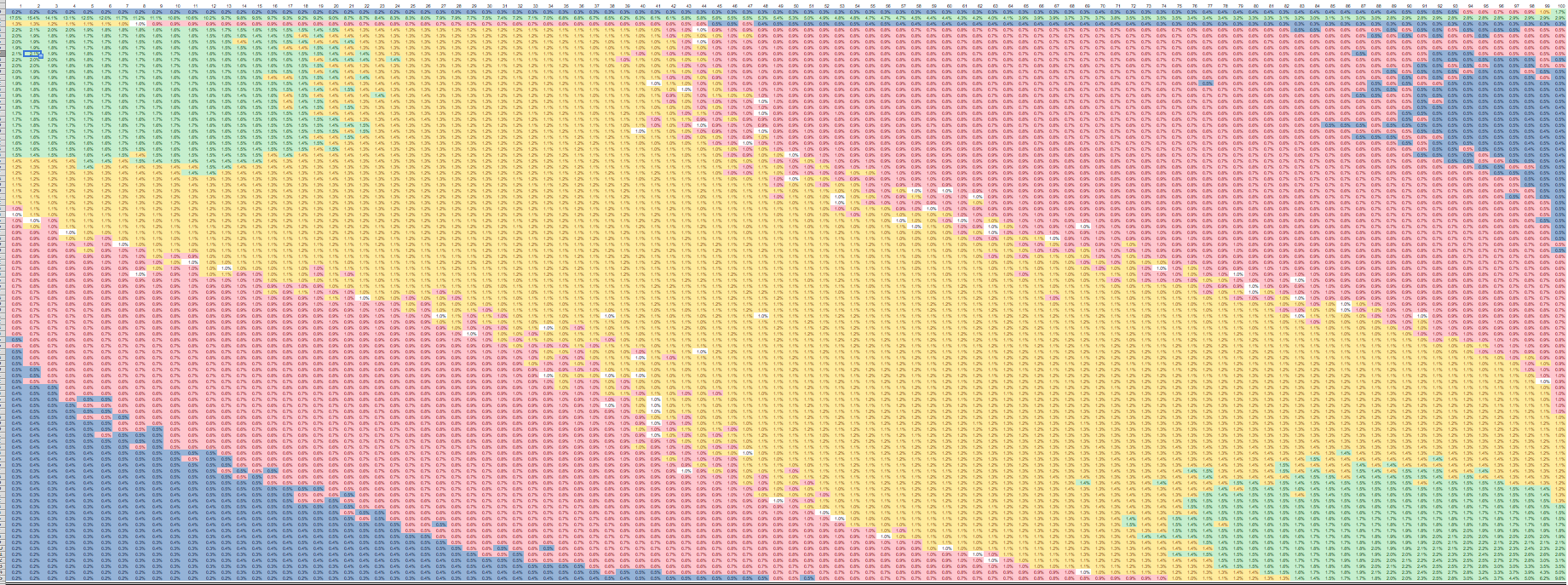

Here is how that curve has moved over time:

Here's the code to calculate that picture: isomorphism.es/post/101890975168/treasury-yield-curve-from-the-volcker-era-through The source is FRED.

Cities and counties collect your taxes. They pay for really expensive things like schools, roads, power plants. [[[cost examples]]]

- creditflux

- munilass

- CUSIP's http://emma.msrb.org/

- http://www.breckinridge.com/insights/podcasts.html

http://apps.chicagotribune.com/bond-debt/chicago-bonds.html

About $54 million from a tax-exempt bond helped cover a legal judgment awarded to African-Americans who were denied a chance to become firefighters by a 1990s entrance exam that favored white applicants. An additional $8 million in tax-exempt bond money went to pay legal fees related to the case, records show.

By using bond money, the city created an irony for many of those awarded damages, as their future property taxes will help pay interest on the debt. In 2033, when the city starts paying down the $54 million, interest will have more than doubled the total cost.

Who benefits the most from tax breaks? Those who pay the highest tax rate. So the federal government rewards the rich if they invest in communities and localities, without asking legislators to pick winners or do due diligence.

Lazy critiques of politicians ignore what a good idea this is. National level rule-makers have incented the rich to give back to communities and locales, with low incentive / price distortion.

due to Catherine Mulbrandon: http://visualizingeconomics.com/blog/2006/11/05/2005-us-income-distribution

Notice that:

- not only do half of the households get by on less than $40k / year, there arearound just a ton of people who (combined, if multiple people work in the home) earn $20k or $30k.

- the rich live in their own world [^ I think you would need a `log(log($))` scale to fit the rich.]

People who index around $100k or complain about how there exist others who make more money than they do (doctors, corporate lawyers, investment bankers, currency traders, whatever) are living in a bubble. Normal Americans make $20k or $30k. (If you assume full-time work = 50 weeks × 40 hours/week = 2000 hours/year, then that would be $10/hour – $15/hour. Normal.)

There are some reasons the $0/year households aren't dead: they might be retired and living off of savings, or they might have negative business income for the year but generally be rich. [[mpls fed]]

Anyway. It's the $10/hr - $15/hr number that we should be interested in increasing. In a capitalist world that means empowering those people. Their productivity needs to go up and/or they need to capture more of what they already produce.

[[atlanta fed]]

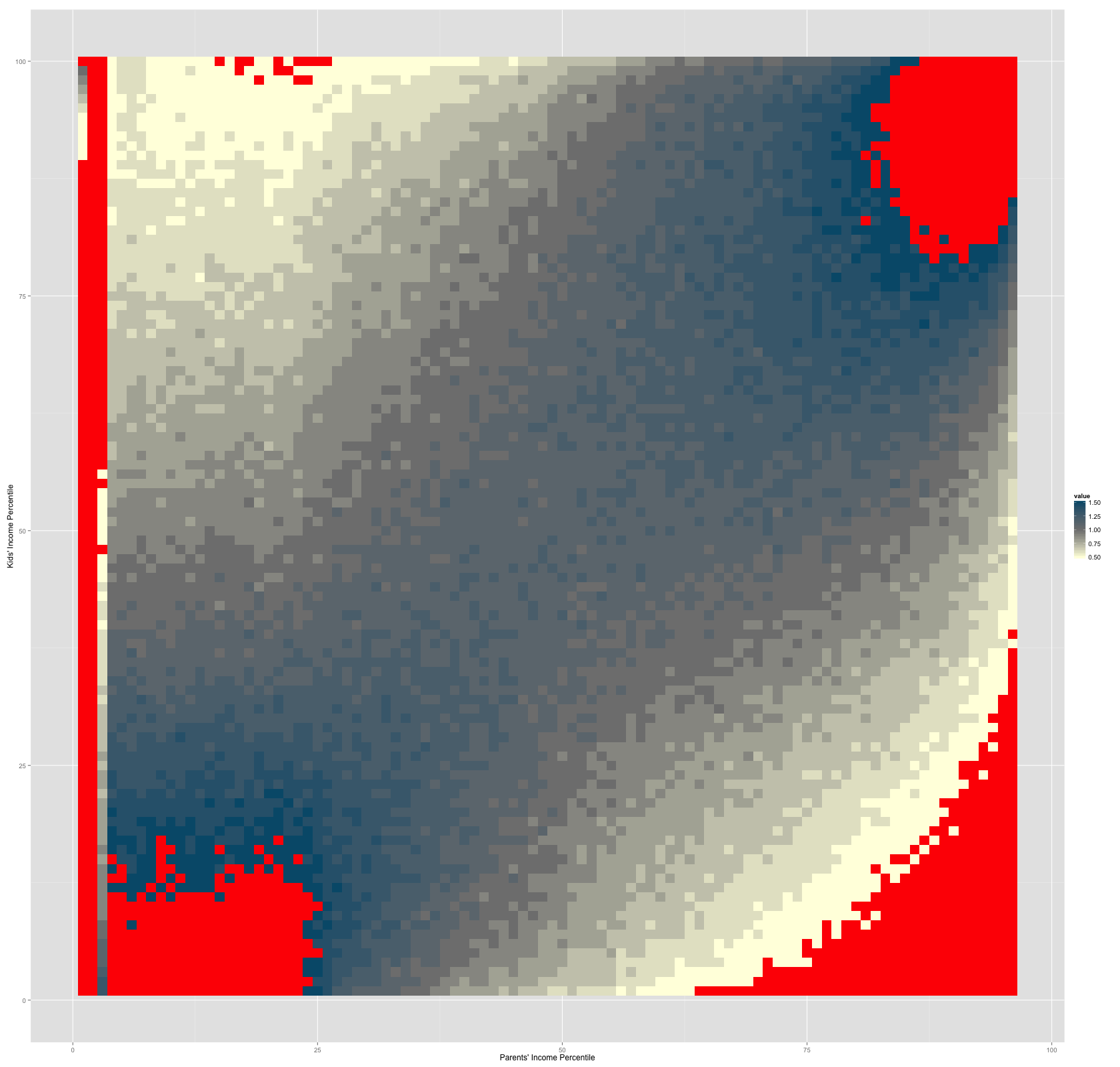

- http://www.equality-of-opportunity.org/

- piketty saez

- Tkacik Vyvanse

People get the things they need and want in life from companies. They earn the paper to buy these things from working at one or a few companies. We have chosen capitalism as the way that things will get done.

https://en.wikipedia.org/wiki/List_of_S%26P_500_companies

| Company | What they do |

|---|---|

| Dow Chemical | chemicals |

| Adobe | |

| Electronic Arts | video games |

| sell ads to you | |

| Fifth Third Bancorp | originate mortgages |

- wildcatting in the Marcellus shale

Rise early, work late, and strike oil.

— John Paul Getty (yes, the Getty of Getty oil

(Getty images?)

By the way, it is a violation of your merchant agreement to charge different prices for cash or credit.

Payment processing

- Braintree

- Authorize.net

- PayPal

- VenMo

- Square

- cash.me

- the other one (Rails people like it?)

- dominic conor (cheeky articles)

- returns per fill

- don't need an engineering degree

why is 5 years of experience the magic number?

https://twitter.com/isomorphisms/status/555751247131979776 ^ things that make no sense

- F Ross Johnson www.youtube.com/watch?v=xCI4zGYYSys (barbarian at gate guy) .. HR the last refuge of the worthless

- epicureandeal .. HR weenies

http://www.forbes.com/largest-private-companies/

| Company | Yearly Sales | Market Cap | Location | # Emp | What they do |

|---|---|---|---|---|---|

| Cargill | a | b | Detroit | x | salt mines (sell road salt to cities for the winter) |

| Bechtel | mining; Halliburton competitor; see [[world bank conspiracy guy www.bostonmagazine.com/2006/05/economic-hit-man/ |

Some losers will call themselves "CEO of [0-employee company]" to try to impress you. It's not impressive. I started a company (by which I mean I filed the paperwork and paid a minimal fee). I had a couple IC's

It used to take an act of Parliament to create a limited liability company (eg, Verenigde Oostindische Compagnie).

You can go to jail if you try to 1099 someone who needs a W-2. This is something you need to do our own legal reconnaissance on and take your own risks, but roughly: if you control the means, method, timing, tools, .......

I applied to a job not too long ago that required on their application form that you are OK with them paying an LLC you control. (That way they don't have to file or pay taxes; you have to do that.) I'm not a lawyer but that sounds all kinds of illegal to me. Plus the CEO seemed shady and their application questions were dumb. But anyway, just because you might get away with it, you might also spend half a decade in a cement cell with six walls around you and an hour in the sun every day with other convicts. Great time to read books though.

- Illinois dude who flouted the law and went to white collar prison

- Orange County debacle

http://www.entrepreneur.com/franchises/sportclips/282819-0.html

I saw an ad for SportsClips in Entrepreneur magazine one time (it's a shitty magazine but for some reason cowork spaces like to stock it. I guess it makes them look like everybody else?)

- Regional Banker magazine

Since as a media owner your job is actually to sell ads, why not just start with a group of people you want to advertise to? Source some shitty articles from shitty writers that are vaguely on topic, figure out how to do glossy printing, and

Every customer is different and so is the government. Since governments have the power to tax and since they pool the resources of a community, they often have a lot of money. And they might not be very smart at spending it.

Witness DoD contracts

- solve terrorism

- blue sky research

- big pitches ((relate to other section))

Witness [[[Medora, Texas

If you want to sell your gym it will be valued proportional to how many credit cards you have permission to bill each month.

Recurring revenues are really important to businesses but don't fit the theory models. Serious problem with theory in my opinion.

Check out Dan Davies' article on Medium, and his book.

Category Started Funded %F ∑Raised TC Posts Advertising 3972 631 16 $8B 996 Biotech 2787 1770 64 $42B 43 Cleantech 1302 719 55 $33B 192 Consulting 3330 176 5 $2B 444 Ecommerce 5383 868 16 $10B 1587 Education 522 60 11 $½B 90 Enterprise 2389 652 27 $10B 993 Games video 3992 910 23 $16B 3625 Hardware 1726 613 36 $12B 3274 Legal 306 23 8 $0.1B 16 Mobile 4101 1099 27 $20B 4263 Network hosting 1782 340 19 $8B 1375 Other 33068 2022 6 $24B 2501 Public relations 2531 468 7 $7B 765 Search 1437 226 16 $2½B 4625 Security 710 218 31 $4B 135 Semiconductor 620 381 61 $9B 27 Software 12405 3039 25 $33B 3733 Web 12830 2401 19 $29B 14356 Category Acqu %A IPOs %I % on TC Avg Funding Advertising 221 5½ 15 ½ 6½ $2M Biotech 332 12 143 5 ½ $15M Cleantech 72 5½ 39 3 5½ $25M Consulting 107 3 15 ½ 1½ $½M Ecommerce 188 3½ 16 ⅓ 12½ $5M Education 4 ¾ 1 ¼ 3½ $1M Enterprise 257 11 41 1½ 9 $4M Games video 285 7 30 ¾ 11 $4M Hardware 139 8 81 4½ 6 $7M Legal 2 ½ 0 0 1 $⅓M Mobile 275 6½ 34 1 13 $5M Network hosting 154 8½ 22 1 8 $4½M Other 2325 7 101 ½ 2½ $½M Public relations 171 18½ 32 1½ 19 $3M Search 57 4 4 ¼ 10 $2M Security 96 13½ 12 2 7 $6M Semiconductor 119 19 51 8 3 $15M Software 1101 9 110 1 5 $2½M Web 827 6½ 57 ½ 14 $2½M

Source: Smaeer Al-Sakhran

"I don't know why everyone doesn't write a self-help book. It's such a lucrative market." ―a self-help guru (cite)

People only buy books in three categories: lose weight, make more money, and xyz. ―James Altucher (quora .. cite)

abc defg

This story demonstrated to a lot of people that advertising is dumb money. At that point they were paying for page views, so he just made the site worse by giving it more page views.

† Corporations aren't here to serve you the best products that make you happy[^ Although this has become the conventional wisdom of the educated class, because you know, Adam Smith or something. Markets in everything!], they are just sometimes forced to do that through rigorous competition. However there is unbridled competition in websites and PoF was still providing a definitively inferior product to customers yet making more money off of it.

That may have changed now, I think ad measurement is different but ad buyers still have a "monthly spend" as in --- I'm the boss, I delegated to you that you need to find ways to spend at least this amount each month, be creative if necessary.[^ But you know, let's still teach Edgeworth boxes because, um. Guess the professors aren't there to serve your interests either? Bingo! Not that they're mean, I think they just have other priorities besides making the prefect truthful relevant class, when it requires fighting against the grain and is not where their bread is buttered. You could argue that it's students' fault for not choosing based on actual academic rigour but rather on how nice the buildings are. ]

Professing is a business these days. ((Was it always? Look at Mersenne

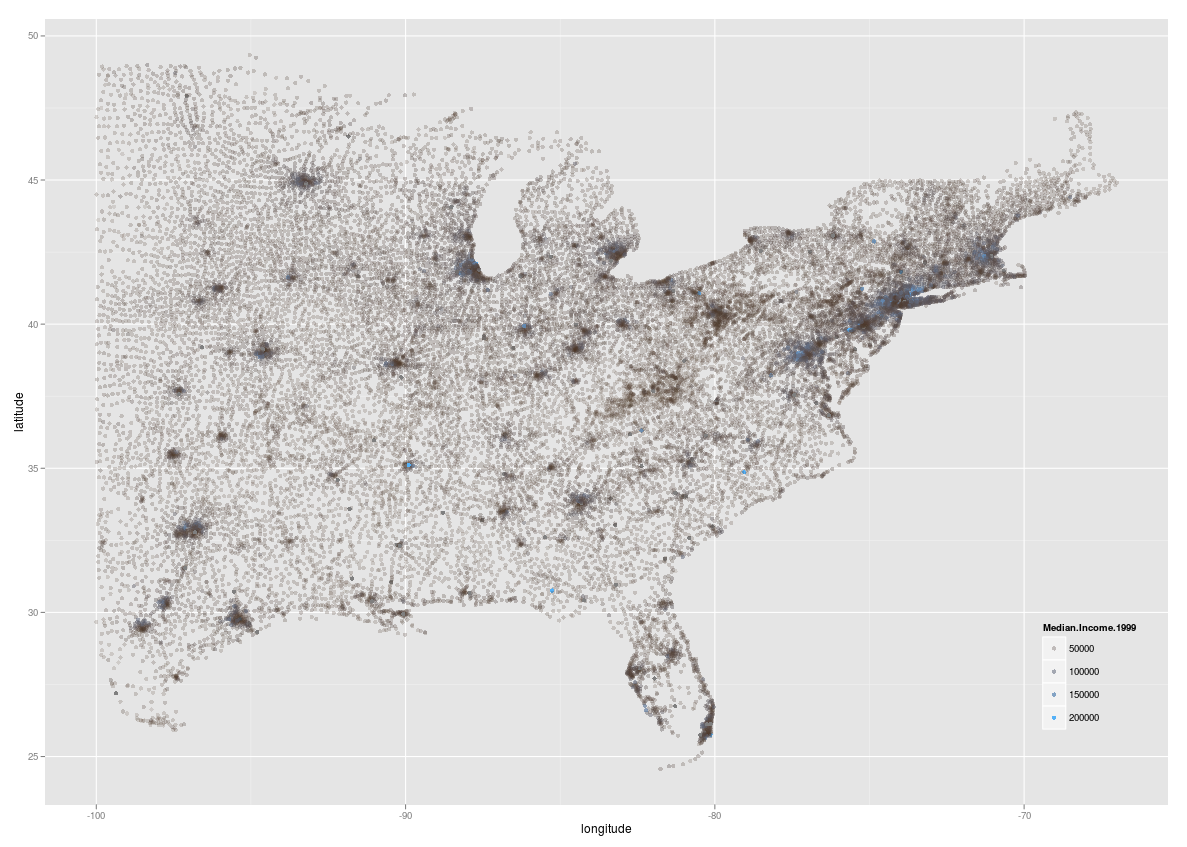

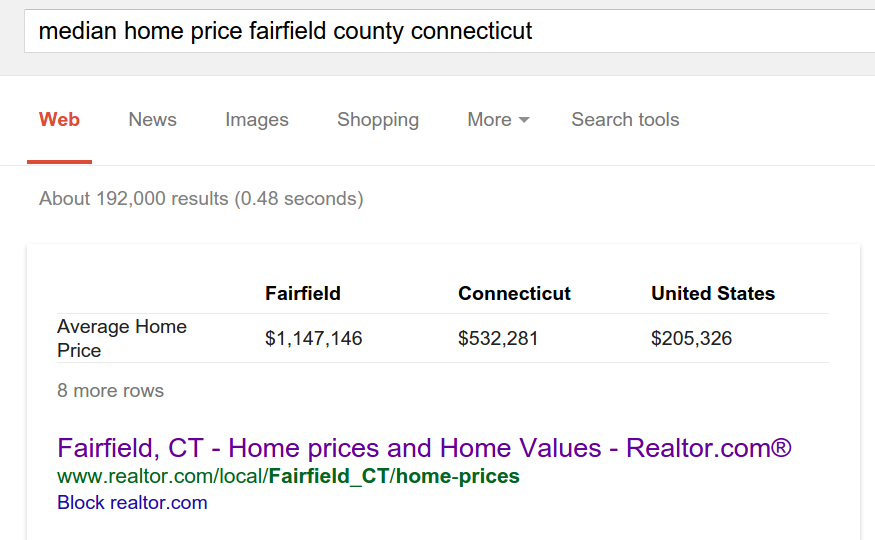

[^ Has it changed much since then? I don't think so, and here's why: [[[pics]]] but if someone has more up-to-date geographic data then we can check.]

- List of 100 wealthiest counties

- Skaneatles Lake

- ↑ spoils of war

due to Catherine Mulbrandon http://visualizingeconomics.com/blog/2014/3/19/average-household-income-by-us-counties

https://twitter.com/isomorphisms/status/458558578853289984 https://twitter.com/isomorphisms/status/458538467295637504

https://twitter.com/isomorphisms/status/608128054842388481

"middle class" https://twitter.com/isomorphisms/status/608126343683940352

the actual middle class → https://twitter.com/isomorphisms/status/524277308484747264 + mulbrandon

https://twitter.com/isomorphisms/status/542580058268110848

(vs thiel / valorisation of rich / TED)

https://twitter.com/isomorphisms/status/572848345527541760 ^ derman career crap, ruby payne

- quora person

- family wealth

- jamie johnson movie

- appanage and the definition of real property

https://twitter.com/isomorphisms/timelines/476938509945962496

Them who's got gets more, while the weak ones fade. Empty pockets won't ever make the grade. Momma may have; Poppa may have; but G-d bless the child who's got his own. ---Billy Holliday

- a

- b

- c

https://twitter.com/isomorphisms/status/458513246136172544

† By the way, it took only thirty (cite) people to make this database.

Never doubt that a small committed group can change the world. ---Trotsky (cite)

I believe great research can change the world. ---Alberto @macrocredit

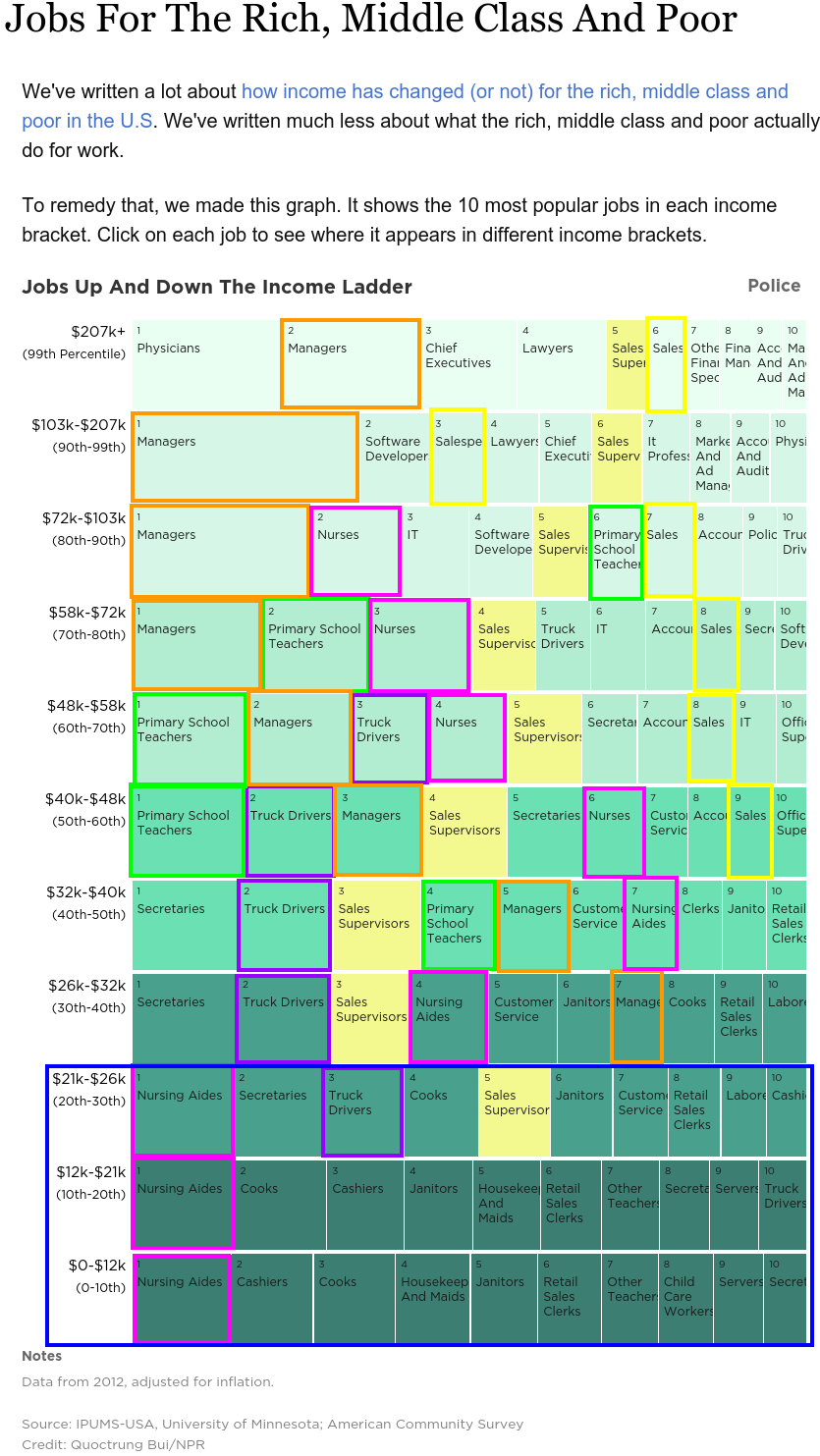

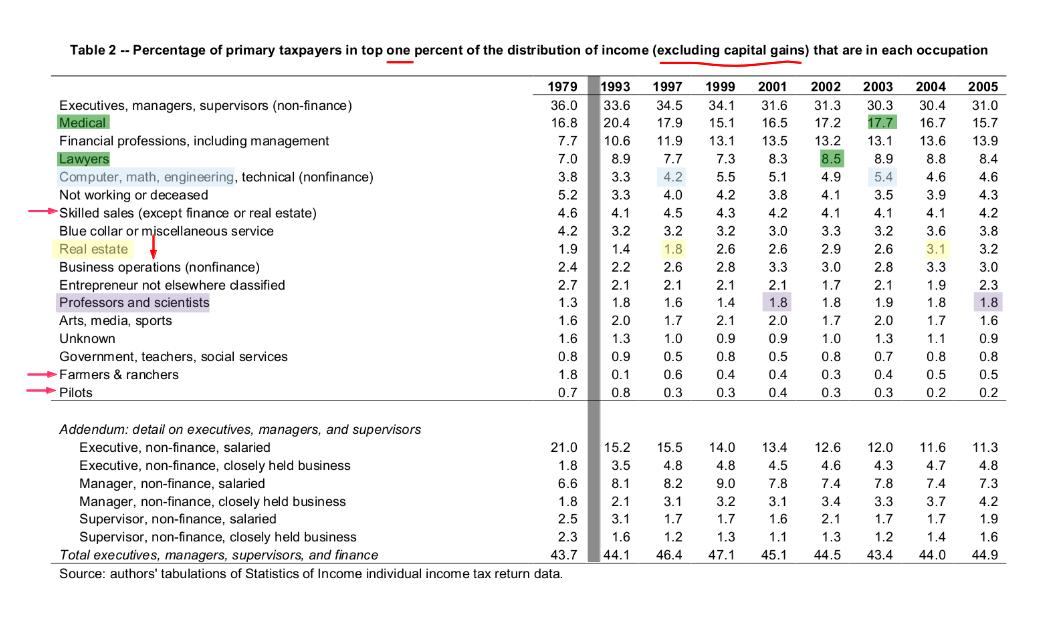

- non-lazy bakija cole heim

- https://twitter.com/isomorphisms/status/568423516661370880 http://t.co/ykoIVjpWiH

This young man seems to me like a totally nice person—the exact kind you don't want to see pulled in by the "logic" of supposedly hard-headed econ-baiters.

- new orleans trombonist who worked at factory

- thelonious monk had a benefactress (heiress)

Obviously: marry someone with two million dollars. The paperwork for marriage is faster than insurance settlements, because insurance companies will always battle you in court to not give you the money. [[quote]]

You can't sideline inheritance

It's a fundamental human right to be able to do what you want with your own money. (That's what "your money" is, right?) But actually, no. You can't hire a hitman, nor should you be able to. And the government steps in to take taxes http://www.econtalk.org/archives/2008/05/nye_on_wine_war.html to finance things. And it should do so. [[because..

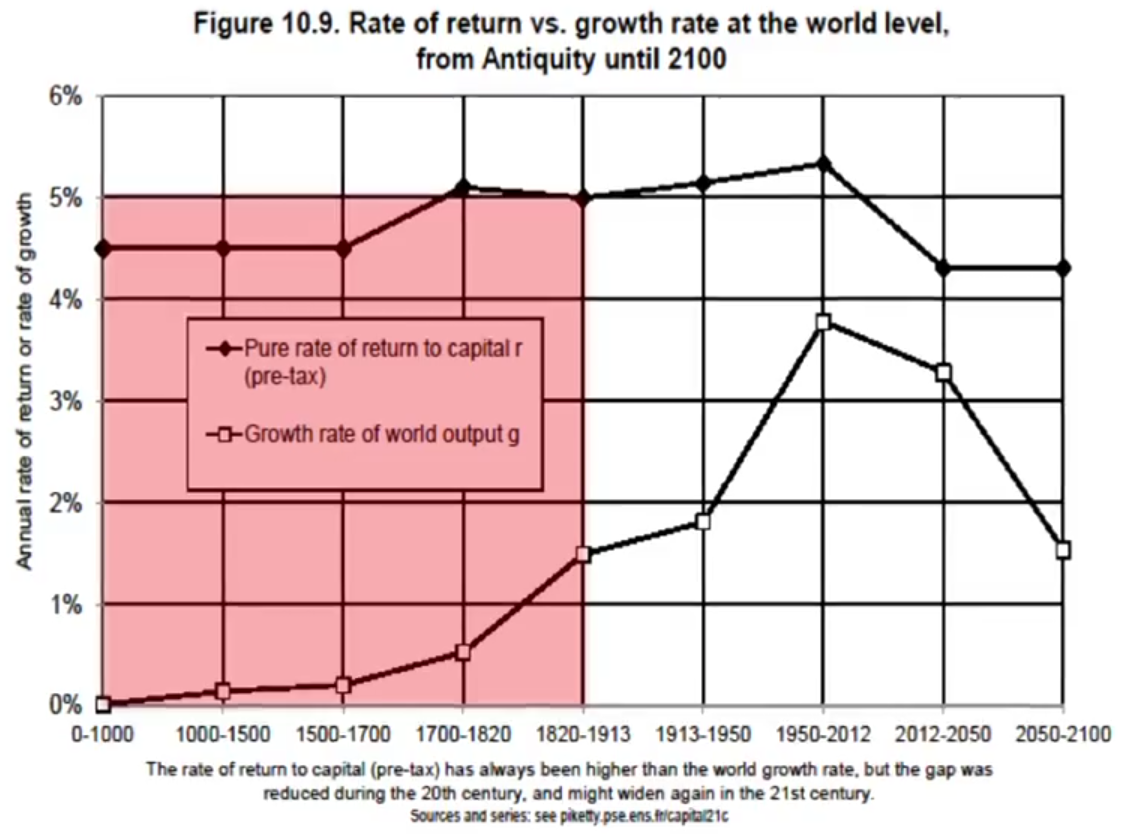

[[[piketty]]]

[[gregory clarke]]

pictures of beautiful white people .. something to make it intense

doing cool things (osheaga)

https://twitter.com/isomorphisms/status/353735295881052162

- https://twitter.com/isomorphisms/status/345318286638059520

- slate article on resumes named jamal

- historically black colleges

- lauren rivera on elite hiring

- kaplan fakey argument ("can't exist bc competition" (sec:labour is not a market))

- Merryl Tisch sits atop the New York public school system. Her husband inherited the chair to the Loews Corporation.

- Alfred Nobel

- Cecil Rhodes—white supremacist, commodity monopolist,

- James B Duke

- William Andrews Clark

poet laureates

https://twitter.com/isomorphisms/timelines/476938509945962496

https://en.wikipedia.org/wiki/Debendranath_Tagore#Children

Father was industrialist; son was Rabindranath Tagore (Nobel laureate)

https://en.wikipedia.org/wiki/Lawrence_Summers

President of Harvard; advisor to Presidents

the son of two economists, Robert Summers (who changed the family surname from Samuelson) and Anita Summers …. He is also the nephew of two Nobel laureates in economics: Paul Samuelson (brother of Robert Summers) and Kenneth Arrow (brother of Anita Summers).

James B Duke. http://www.neh.gov/about/awards/jefferson-lecture/wendell-e-berry-lecture

The economic hardship of my family and of many others, a century ago, was caused by a monopoly, the American Tobacco Company, which had eliminated all competitors and thus was able to reduce as it pleased the prices it paid to farmers. The American Tobacco Company was the work of James B. Duke of Durham, North Carolina, and New York City, who, disregarding any other consideration, followed a capitalist logic to absolute control of his industry and, incidentally, of the economic fate of thousands of families such as my own. … on my first visit to Duke University, and by surprise, I came face-to-face with James B. Duke in his dignity, his glory perhaps, as the founder of that university. He stands imperially in bronze in front of a Methodist chapel aspiring to be a cathedral. He holds between two fingers of his left hand a bronze cigar. On one side of his pedestal is the legend: INDUSTRIALIST. On the other side is another single word: PHILANTHROPIST. The man thus commemorated seemed to me terrifyingly ignorant, even terrifyingly innocent, of the connection between his industry and his philanthropy. But I did know the connection. I felt it instantly and physically. The connection was my grandparents and thousands of others more or less like them. If you can appropriate for little or nothing the work and hope of enough such farmers, then you may dispense the grand charity of “philanthropy.”

He would be a beggar should practice on statues. ---Diogenes

$3/hr begging in Los Angeles

- Youtube kid selling gums

- beggars sawing off their legs

- S Viet Nam spending rates 1964

- incomes in primitive areas

- Moken people

- Amazonian / subsistence level / Andhara Pradesh

You can probably imagine what would happen if small economic changes were made in your workplace, your friends' lives, your community. What would you do with a 5% raise?

But what if the minimum wage were multiplied by ten? What if not only you got a million dollars, but so did everyone on your street? Big changes are harder to think about. The reaction to the initial "stimulus" (let's say it's a law) might become really important too.

Does finance serve any useful purpose? The first way to argue it does is to think about home loans.

Railways through Africa. Dams across the Nile. Plantations of ripening tea.

(The bank will repossess your house if you get too far behind on your mortgage. However they will likely take a loss so it is bad for both parties. Otherwise you could expect that banks would loan to whomever. If they could resell the house at face then a mortgage would involve no risk to them so they would just do it as much as possible. [[student loans tkacik]]

Over time consumer credit has expanded into car loans and credit-card loans. [[[frb research on cc debt]]]

physical delivery is not the point of derivatives, mark-to-market payments are. The miller in last week's example will never deliver wheat into his futures contract; when each contract delivery comes up he will "roll" it into a future delivery month (that is, if he has a January contract to sell wheat, in January he will enter into a January contract to buy wheat, offsetting his existing contract, and also enter into an April contract to sell wheat). This is the same as a business that takes out a money loan, when that loan comes due the business will take out a new loan to repay it. It's not the principal that matters, it's the interest payments. Only when businesses change or liquidate are the derivative positions shut down and the loans repaid.

Now we can see why derivatives are so revolutionary. It's not the ancient notion of a fixed-price contract, it's the active exchange, the standardization and the clearinghouse that create a new form of money. That's what happened in 19th century in the Mississippi River system, and again in the 1960s and '70s all over the world. This is what makes derivatives something modern, not a 4,000-year-old concept.

Derivatives stimulate the economy by financing businesses and facilitating transactions, just like a banking system. We can also see why financial engineers worked so hard from around 1965 to 1980 to replace national-government-issued credit-backed money linked to gold with derivative money designed after the model of futures exchanges. Milton Friedman lobbied President Nixon to take the world off the gold standard, Merton Miller worked hard to get approval for trading of futures and options on financial underlyings, many other people worked to get approval of financial institutions outside the regulated banking system to take deposits (money market funds), make loans (mortgage lenders who securitized their product rather than lending deposits from the public) and invest money (public mutual index funds instead of broker-managed accounts).

Beginning in the 1980s, another important change was redefinition of bank capital. Credit-based bank capital is equity contributed by founders or earned as profit. It serves to cushion credit losses. If a borrower does not

http://daskrap.com/2012/8/unconstitutional-40-years-war-college-students

In December 1975, when Congress was debating the first law that made student loans non-dischargeable in bankruptcy, University of Connecticut law professor Philip Shuchman testified that students “should not be singled out for special and discriminatory treatment,” adding that the idea gave him “the further very literal feeling that this is almost a denial of their right to equal protection of the laws.”

[shuchman1]

The thing was, discrimination was kinda the whole idea. Stagflation was sending an unprecedented number of Silent Majority members into bankruptcy, and the bank lobby was fighting back with a propaganda assault that scapegoated counterculture student delinquents who were allegedly taking loans with no goal of paying them. As Shuchman and others explained in hearings, only about 4% of people who filed for bankruptcy protection in 1975 had student loans on their balance sheets, and of those fewer than one fifth did not have substantial other debts motivating them to file.

But try telling that to anyone who'd been reading the papers! A typical syndicated dispatch on the surge in student deadbeats was the August 27, 1972 expose of Los Angeles Times reporter Linda Mathews, which began with the personal anecdote of an anonymous “Washington banker” who purported to have once “handed a $1500 check” for the year’s tuition to a nameless “ 18-year-old college freshman” only to be insouciantly told, “Oh, I never intend to repay this loan.” The kid was merely acting on the advice of “ underground newspapers,” the anonymous banker—who had since joined “the staff of the American Banking[sic]Association”—helpfully explained.

[Picture]

“Elitist cheaters” and “professional deadbeats” had driven default rates “as high as 40 percent in some cases,” the Chicago Tribune fumed. “Sometimes when I see someone come out before me with a job and no other debt but a

Credit was in general use in ancient and in medieval times. Credit long antedated industry, banking, and even coinage; it probably antedated primitive forms of money. Loans at interest may be said to have begun when the Neolithic farmer made a loan of seed to a cousin and expected more back at har- vesttime. Be this as it may, we know that the recorded legal history of sev- eral great civilizations started with elaborate regulation of credit. For example, about 1800 B . C ., Hammurabi, a king of the first dynasty of ancient Babylonia, gave his people their earliest known formal code of laws. A number of the chief provisions of this code regulated the relation of debtor to creditor. The maximum rate of interest was set at 33 1 ⁄ 3 % per annum for loans of grain, repayable in kind, and at 20% per annum for loans of silver by weight. All loans had to be accompanied by written con- tracts witnessed before officials. If a higher than legal interest rate was collected by subterfuge, the principal of the debt was canceled. Land and movables could be pledged for debt, as could the person of the creditor, his wife, concubine, children, or slaves. Personal slavery for debt, how- ever, was limited to three years. Twelve hundred years later, around 600 B . C ., the legal history of clas- sical Greece began with the laws of Solon. At that time, drastic reforms were necessitated by an economic crisis in Athens, stemming in part from excessive debt and widespread personal slavery for debt. In contrast to the Code of Hammurabi, the laws of Solon did away with all limits on the rate of interest. They reduced or canceled many debts. They permitted hypothecation, but they forbade personal slavery for debt. These laws endured for centuries. The Romans also began their legal history with a body of laws regu- lating credit. This, too, was forced by a crisis characterized by excessive debt. The famous semitraditional Twelve Tables, dating from around 450 B . C ., insofar as they deal with credit, resembled the Code of Ham- murabi more than they did the laws of Solon. Interest on loans was limited to no more than 8 1 ⁄ 3 % per annum. Higher than legal interest was penal- ized by fourfold damages. Personal slavery for debt was permitted, but the physical well-being of the slave was protected. These three examples from the earliest days of historical Babylonia, Greece, and Rome are enough to support the conclusion that credit at interest was widespread enough to create major political problems before the emergence of written history. The entire 5,000-year span of written history, however, is equal to only about one-half of one percent of the duration of human life on this planet. People had plenty of time to learn a lot about credit and interest before they began to write it down. Moving forward in time, we note that the Capitularies of Charlemagne, circa 800 A . D ., also dealt with credit. They flatly forbade all incre ments on loans. The sin of usury, and the desire for legal exceptions, provoked major theological and legal controversies for more than a thousand years of the Middle Ages. After the Reformation had justified the charging of interest in northern Europe, the interest rate controversy was taken up by economists, financiers, and politicians, usually in terms of laissez faire versus state control. England eventually followed Solon and abandoned all fixed legal limits on the rate of interest. The states of the United States in their usury laws set fixed maximum rates of interest and in this respect continued the legal traditions of Hammurabi and Rome.

Any way you slice it, the banking business is about borrowing cheap and lending dear. The economic question is how that goal set affects the rest of us.

Carolyn Sissoko emphasises that lenders prefer to loan against collateral. If you don't pay them back then they get to take your thing.

Treasury bills are considered so secure that they make good collateral. I get money today while you hold my T-bill. If I don't pay you back with interest then you already have my T-bill and don't need to come looking for me. [^ Believe me --- if you've never run a business --- chasing customers down for money _they already owe you_ --- you've already "made the sale" and done the work --- is a huge pain in the ass and a feature of every business. That is why `accounts receivable` is a major accounting category. People try to wriggle out of paying, for real.]

You'll need to think through the mechanics a few times before you get it.

- libertystreeteconomics.newyorkfed.org/2011/04/everything-you-wanted-to-know-about-the-tri-party-repo-market-but-didnt-know-to-ask.html

- geithner

According to Tim Geithner's book Stress Test, repo is the main way that hedge funds financed trades. The problem with getting financing from the money markets is that, since the terms change every day, you can't count on them too much. Big companies need a department that does nothing but plan and predict treasury financing. In the crisis of 2008 the money markets just stopped offering companies money. Imagine that you are used to borrowing in ranges like 3, 4, or 5 percent and then one day the market was offering 500 percent at best. If your business runs on debt (most public companies do --- see [[LBO]], requires a lender to go through the basic operations of paying your vendors and employees, shipping your packages and . Maybe for a while you can put people off. But what if the money markets aren't back next week? next month?

This seems like an important feature of today's economic, capitalistic setup. Because of specialisation most companies rely on a lot of other companies to do necessary parts of their business for them. In fact vertical integration is illegal [^ for other reasons]. Imagine that you ran an auto body shop and one day all the people who supply you with paint are gone. You could only serve the customers with the paint you had left. Maybe you talk them into getting a weird color that's "close"? And then what do you do when the paint suppliers are still gone a month later? Do you try to figure out how to make auto paints yourself? This is just one example of [[general equilibrium]] problems: the disappearance of auto-paint suppliers would cause a ripple effect.

[^ Microsoft is an exception [[link]] ] Microsoft going to the bond markets

(A couple years ago business academics wrote papers about "hoarding cash" ... not coincidentally journalists in major newspapers were talking about "hoarding cash" ... not coincidentally people and their friends were losing theri jobs, fewer people were hiring, and corporate profits were high. Hence, "stop hoarding cash, you big bad corporations".) https://www.stlouisfed.org/Publications/Regional-Economist/January-2013/Why-Are-Corporations-Holding-So-Much-Cash http://www.economist.com/news/leaders/21620203-japanese-and-south-korean-firms-are-worlds-biggest-cash-hoarders-hurts-their [^ In case you didn't notice, "hoarding" is a negatively charged word for "having". ]

http://money.stackexchange.com/questions/23593/what-happens-if-my-order-exceeds-the-bid-or-ask-sizes

Source: http://www-bcf.usc.edu/~lharris/Trading/Book/Book-extract.pdf

†NB: Madoff! When he was still seen as clean (2002).

"The" market price is a misleading concept. [^Matters for the "mark to market" geeks. ((delong: "mark our beliefs to market" . economist articles)) If you view the bids & asks as two histograms moving left & right over time and rarely crossing, _across multiple exchanges_, then this is "the market", cheaters and tricksters and all. What is the relevance of the last print --- let's say in a low-volume stock it was two months ago? Or should you use the midpoint of bid & ask? What if there happen to be more tricksters on the upside waiting for dumb people to jump in because of a news story? What if just by chance (or because it's easier to value in their model) someone happens to list way-out limit orders in the ? And how the hell does any of this relate to "bets on opinions" and Surowieckian Intrade market-price fetishism?]

Let's say the last print was two days ago at $13. Since then the bids & asks have moved up to argue around $14, but haven't crossed again in that time. Are you still going to say "the market price" is $13?

- prints vs non-crossing arguments

- Is it that much more significant when two bids & asks momentarily cross? What about a "continuous" measure based on the nearness of the b & a?

- real estate deals ((("you're talking to the wrong guy" --- story of the handshake --- charisma .... NP comment that friendly midwestern guy and priests do better than NYC rude bond salesmen

- (((and again when it's a conversation power of sales, it's no longer a transaction stripped down only to price and don't care whom you get it from ... small businesses, dealing with family, dealing with repeat clients, etc ...... "mark to market" gfy

- OTC (phone conversations .... volcube chat)

- what you need to say on your economics test to pass as a sophomore, versus [[[the economists don’t actually think about actual arguments .. it’s just "market magic"

- peter cotton .. crossing the magenta line

Let’s take a look also at another visual of an order book. Here is a bitcoin exchange snapshot, taken at roughly Thu Aug 6 18:45 UTC 2015.

Source: http://bitcointicker.co/

[mt gox scam. photo of "short bitcoin" libertarian jerk guy / goog search. lot of people like him showing up]

- rgm test example http://rgmadvisors.com/problems/orderbook/

Here are the prices that were listed throughout the day.

You can see the "conversation" / "argument" about the value of this stock stays within a remarkably small band. [^So maybe it has to do with the players who were arguing that day? A lot of traders looking to make a tick simply by gaming the others' mistakes or filling random small-lots orders as they came in from individual investors / brokerages, and nobody with a strong opinion about the fundamentals of the company?]

this is "the truth" (at least on that day). When traders talk about a "1000 sigma day" in the Weimar hyperinflation, they mean this sigma. (Not the religious "population sigma" of bell curve veneration)